also see: throughput accounting…a natural for hospitals? Linkedin thread

also see: throughput accounting (TA) vs activity based costing (ABC)

also see: FTE vs cost accounting… when PUNs equal CUEs

also see: When you’re lost, use a map…

also see: Graphic Simulation Interactions of Constraint Theory and Lean

also see: Getting Dr. Able out of the OR before 4pm…

From LinkedIn conversation : Why aren’t more hospitals adopting full-blown cost accounting systems? | LinkedIn

Why aren’t more hospitals adopting full-blown cost accounting systems?

Only about one third of hospitals have full-blown cost accounting systems. In the current issue of HFMA’s Strategic Financial Planning (http://bit.ly/12rMZmU) Gregory M. Adams, FHFMA, president, consulting services, Panacea Healthcare Solutions, Inc., provides this explanation:

“As a CFO, I need information that is accurate enough to support management decisions, that allows me to drive prices off of costs, but I don’t want to build a cost accounting system that takes more time and effort to maintain than the value of the information I get out of it,” said Adams. “The answer for Holy Name Hospital, and for many other hospitals, is a hybrid: the RVU (relative value unit) costing methodology.”

Please share your views on this topic.

Christine Levine, Steven Raby and 4 others like this

45 comments

Colin Lay • I cannot access the article for reasons beyond my immediate control.

However, I suspect that most hospitals that avoid developing a “full blown cost accounting system” have a very limited view of what it can be useful for.

The Institute of Medicine (amongst others) have stated that about 30% of care delivered to patients is pure waste, and is physically and financially harmful to patients. The push-back has started and will force hospitals to identify and eradicate wasteful care. If 30% of the charges represent waste, how much does that represent in real cost of service, and how much does it cut from the bottom line, if the insurers start denying payment for unwarranted services (even more than currently)?

Which specific services are actually waste for any group of patients, and how many groups of patients does the hospital need to track? Which hospital departments will be hit most, and by how many dollars?

Driving “prices off of costs” reflects the current expectation that any service delivered should be charged and reimbursed. That fee for service practice will be de-emphasized more and more over the next few years.

Why does a hospital need real cost accounting (or ABC or TDABC)? Because it provides a strong platform for the analysis of the impact of stricter control of best practice treatment protocols, and best practice production of services for delivery to patients.

There are many ways to become more efficient and effective. Enterprise Analytics will identify what is working well, and what is not. It will identify the bottom line impact, showing total dollars gained or lost by specific department and service, and by specific patient type, and clinical group.

Brian Gregory, MD, MBA • Sounds a bit like benchmarking 🙂

If they’d just look at TDABC or ABC in a way that uses the units of costs ‘$’ as an ordinal or ratio measure and not ‘just’ for deciding the financial viability of a project…then they’d have an entirely new level of analysis and relevance open to them. Don’t try to fit a measure into an inappropriate category…one of the rules of systems engineering!

Robert Lewis CPA, MBA, FHFMA • First of all I don’t really know the definition of a “Full Blown Cost Accounting System for Healthcare” but I will allow a few thoughts anyway. Most CFOs that have survived for any length of time have a fairly reliable method to determine if revenues exceed variable costs, by service line. Drilling down further; most have adopted some form of 80/20 approach to analyzing cost, meaning that they may focus efforts on high dollar/volume areas such as surgery, or ER. That is not to say that what was adequate in the past will be viable in the future.

I never met a CFO that would not love to have accurate procedure code level costing at their disposal. But getting there is both very capital and extremely labor intensive. Additionally there is no generally accepted accounting principals for cost accounting, leaving the development of costing methods and philosophies to each implementation. Granted, Activity Based Costing has theoretical promise but requires green eye shades and a stopwatch, making it quite a cultural challenge. A cost accounting system that does not separate fixed and variable costs as well as direct and indirect costs, at the reporting level; is worse than useless. Developing these is much more difficult than you can imagine if you haven’t tried to do it. And. if the user does not know what is included in a cost figure, any decisions made relying on the data will be highly at risk. Also, the system must be kept up to date with fresh costing and statistical data. In the end a lot of costs wind up being developed by various statistical measures for expediency. Pragmatic CFOs will assess were these efforts hit “diminishing returns” and where it fits in there strategic and tactical plans. This is my guess as to why there are not more Full Blown cost accounting systems.

Brian Gregory, MD, MBA • Hi Robert…it’s good to have an experienced CFO practitioner to keep the conversation grounded. So I’m going to take advantage of that…

Correct me if I’m wrong or if you have a different way of looking at it:

What a CFO usually wants is some measure(s) that tell him(her) whether an activity (process) is financially solvent (profitable), usually in a quantitative matter so that the activities can be ranked in order of profitability. The most profitable ones are supported, the least profitable (or negative) aren’t.

Notice that I said process and not cost of an item. The total cost of the process (ABC) is more important than the cost of a single item. Confounding the analysis is that a particular single item that is in more than one process can have dramatically different effects on the cost of different processes. Often that different process cost is related to an effect the item has on the time it takes to complete the process (TDABC).

To make things more complicated, most processes are composed of sub-processes (start an IV before starting anesthesia or giving medications). And some of those processes could have substitute processes (therefor not needed) in the scope of a larger process.

So, trying to figure out the cost (opportunity cost?) of an item within a subprocess of a larger process is some science, some art, and some nonsense.

But…

What if the CFO had time data (how long it took and how often the process was performed) for these processes (and sub-processes) within different contexts (departments) in a hospital? Some departments might be able to accomplish the same process (or a substitute process) in a considerably shorter time than a different department. A substitute measure of time and frequency of use could be a cost allocation (that’s what cost accounting is, isn’t it?)

The CFO would end up having a valuable database for benchmarking processes. Not only that, he’d be able to walk down the hall and see if the most efficient technique of implementing that process (or substitute process) in one department could be used in other departments that weren’t as efficient with the process.

We did this years ago with the use of anesthesia for pediatric radiation therapy at KFSH&RC and published a paper on it, but the focus was on safety and results of the radiation therapy….not cost. As for the productivity results, we cut the time for each radiation treatment so much that what used to take 8 or 9 hours a day ended up taking 75 or 80 minutes total. At least 4 personnel from radiation therapy (and equipment) were freed up to perform other treatments. A CFO with data on costs of ‘sedation/anesthesia’ would have seen this much sooner. As it was, my friend (the radiation oncologist) had by chance asked at dinner if I thought we could help speed things up — an inefficient chance occurrence. The CFO would now be part of the clinical community.

Here’s the paper:

“Evaluation of the safety and efficacy of repeated sedations for the radiotherapy of young children with cancer: A prospective study of 1033 consecutive sedations,” (with G. Seiler et al), International Journal of Radiation Oncology, Biology, Physics, 49(3), 2001.

Colin Lay • Brian – when, if ever, did the CFO become part of the analysis of the radiation therapy situation?

My point in asking the question is that financial and clinical people have to develop great understanding of each other’s domains in order to exploit the kinds of efficiencies that you showed in this example. (Oh yes, why, or why not, cost accounting?)

I vividly remember sitting in a room at the HFMA ANI in Seattle a few years ago where the presenters were talking about how they were organizing their Cardiovascular Service Line. One of the presenters casually mentioned “Triple A” (AAA). I stood up during Q&A and asked how many people in the audience knew what AAA meant. There were about 100 to 200 people in the room, and I did not see any hands go up. I was saddened, but not shocked, by the lack of even recognition of the term.

During my teaching career I counseled our MHA students to make themselves as knowledgeable as possible about the real business of healthcare. I believe it is not about chasing dollars, but about helping people stay well, or recover from some illness, or at least be as comfortable as possible in living with an illness. The students should stretch themselves regardless of their previous background in the delivery of healthcare (some were doctors, many were nurses, but many had no previous exposure to hands-on patient care).

Of course responsibility flows in both directions. Yesterday, Medscape carried another story about patients not understanding either the benefits or risks of the CT scan they had just had. That comes after a short-lived upset about the prevalence of patients undergoing 2 CT scans on the same day. (NY Times June 17, 2011 “Hospitals Performed Needless Double CT Scans, Records Show”) The problem? A chest CT scan gives a radiation dose equivalent to 350 chest X-rays. Radiation causes cancer. (Newer CT technology may reduce that figure, but not down to 1, and not in most hospitals.)

Where does the finance department get involved in these kinds of decisions? What is the responsibility of doctors?

Brian Gregory, MD, MBA • Colin, times are changing.

Last Friday at the SHS2013 meeting in New Orleans I moderated the follow session:

“Evaluating The Financial Viability of Particular Operative Procedures Using TDABC Lawrence Rosenberg, McGill University”

Many (all?) of the people were associated with Jewish Hospital in Montreal. Lawrence Rosenberg is a surgeon, Phil Troy is an industrial engineer and computer wonk, the speaker for the presentation (Sam) is in a joint MD/MBA program. They’re taking the interaction of finance, industrial engineer, and clinicians seriously in order to adapt to decreasing funding of healthcare in Canada.

I thought that only 3 or 4 people would be in the audience. By the end of the session, there were about 40 people. I don’t know if any were CFOs.

Dan Baccus • I think it is important to keep in mind that for years hospitals have not fully operated as businesses. I have worked for institutions where all of the c-level executives and managers were clinicians with no real business experience or training to prepare them for their positions. It was not unusual for health care providers to promote clinicians to business positions who could not perform the duties of the positions.

I do think some health care facilities, especially hospitals, are coming to the realization that they need accountants, financial analysts, etc., to perform business specific tasks. Slowly but surely the hospitals will stop giving business specific jobs to current employees just because they have worked at the hospital for years. It is quite possible health care facilities will start hiring CPAs, CMA, and MBAs.

Brian Gregory, MD, MBA • “Brian – when, if ever, did the CFO become part of the analysis of the radiation therapy situation? ”

In the situation I described, the time was cut from over 8 hours to 75 minutes. That’s a large change in resources, cash flow, potential revenue, etc. We dramatically decreased costs and help the financial status of the hospital…yet the CFO was totally unaware and probably took credit for the bottom line boost. There were plenty of CPAs, CMAs, and MBAs around who had nothing to do with it;…. just a couple of savvy docs who understood the clinical process.

Brian Gregory, MD, MBA • To get back to the original question quandary:

“As a CFO, I need information that is accurate enough to support management decisions, that allows me to drive prices off of costs, but I don’t want to build a cost accounting system that takes more time and effort to maintain than the value of the information I get out of it,” said Adams. “The answer for Holy Name Hospital, and for many other hospitals, is a hybrid: the RVU (relative value unit) costing methodology.”

Is the major cost and effort related to collecting raw data (time, and original bills for materials?) or is it due to trying to divide up those elements into portions that are relegated in a discretionary manner to processes (and re-relegated over and over in an attempt to improve costing)?

If discretionary relegation is used, is the relegation added piecemeal before the processes occur (with possible errors of actual use), or is it done quickly afterwards by computer with the aid of a database that shows everything that was actually used for a process and with access to bulk costs of materials, human resources, etc. which can then be used in a simulation fashion to play with discretionary relegation until something makes sense…and which may also show shifts in processes when that relegation ceases to make sense.

Does anyone calculate lost opportunity costs? Is that more important than adding up the relegated costs? Is the point to improve cash flow, or keep a somewhat fictional account of costs? Relational value (ordinal) is easier to see than absolute value (I can tell you which car is going faster as it heads for the finish line even though I can’t tell you its speed.)

Tough question, Anna.

Robert Lewis CPA, MBA, FHFMA • Hello Brian

My assessment was in response to the original question “Why aren’t more hospitals adopting full-blown cost accounting systems?” I agree with you that processes should be continually analyzed, from an operational standpoint, asking the hard questions, to insure that best and most efficacious process practices are in place to the greatest extent possible, specially using an 80/20 approach. But that is a different idea, I believe, than a full blown cost accounting system that will at some point reach diminishing returns for the effort.. It would quickly become a massive bureaucracy, if done in a “full blown” manner. Ad hoc cost analysis in support of focused process analysis, I believe, is move useful at this stage of available IT solutions and internal analytical capability. There are simply too many moving parts and process variations in most facilities currently to implement an accurate and effective “full blown cost accounting system”. There are exceptions to this assertion of course, and in the future it may evolve to a different level.

Brian Gregory, MD, MBA • Hi Robert,

OK…bear with me…tell me if I’m out to lunch…

Would it help alleviate the massive bureaucracy if you kept track of processes (for comparison between departments and locations) at a level that’s only detailed enough to show that one location is being more efficient or productive with that process than another?

If you could leave the details of the process to be sorted out to those clinically involved, other departments would probably be able to quickly see if there’s an advantage to emulating the implementation of a specific (or substitute) process that show’s up best by your preliminary data. (An example would be the use of a particular brand of IV catheter that takes less time to insert that currently is used only by radiology.)

The data entered by the IV starter would be the person starting the iv, brand, and duration of IV starting. The rest of the data you’d already have. If you wanted to record use of a machine…You’d have time (start and finish) of machine use which would also give you the frequency of use, person using the machine, purpose, and patient data. Most of that’s already done. Use this data between departments and silos to see if someone has a much better way of accomplishing a process goal.

Whatever the cost from tallying all the processes for a particular DRG code, you can begin improving (by comparison of implementations of similar processes or goals in different departments) costs. The clinicians can make the decision about the myriad minute details of difference between the implementations and if it’s possible…they just need a lead to where there might be a better way. [You’d also discover those who are spending a fortune when it’s not necessary.]

So, you’re using cost data augmented by other already collected clinically relevant data, and you’re using the experience of clinical personnel to avoid having to collect a lot of other data (but just having them take a look at how others are doing it).

Well…. I’ve never tried this. What are the potential problems?

Brian Gregory, MD, MBA • The same thought process would apply for capital asset purchasing and utilization assessment of personnel (FTE) and equipment before cash outlays.

Anthony Wunsh • If I may be so bold as to step into this conversation with some thoughts and insights.

The culture within costing, pricing and profitability in a hospital and in fact in Health Care in the USA is dictated by third party influence. Nothing I am aware of is looked at in the context of how much time, cost and inventory is required to determine what to charge, why to charge it or how it fits in context to the bottom line.

It is determined by what the insurer (government or private payer) will pay. And for generations this has been the case, thus creating even an internal environment where the typical costing and accountability towards cost factors has been either ignored, forgotten or irrelevant.

And this is a real challenge in an environment that is seeing that third party forcing more of the risk onto the patient directly (higher co-pay, co-insurance and deductible dollars), reducing reimbursement and demanding more transparency in pricing from both legal entities and the end user (patients).

And of course we all recognize that in health care it is not as simple as determining what is profitable or not in determining what can and what must be provided. But it can be a factor which if deployed helps with both bottom line and cost of services.

While complex, it is also simplistic, all processes, items sold, staffing needs, facility requirements, equipment purchases, marketing, and all other business required needs should be accessed based on factual data and analysis which drives better decisions.

But as long as third parties set price, supply, demand, reimbursement, consumption levels and most other factors, getting to a fully functional accounting system that resembles other industry standards is at best a challenge, at worst impossible.

Brian Gregory, MD, MBA • Anthony,

To me it sounds as though there’s currently a great opportunity to take advantage of insurers miscalculation of costs….if you have the enterprise data that we’ve been discussing.

Brian Gregory, MD, MBA • The more I think about it…You’re a genius, Anthony!

If you could collect the enterprise data as I discussed, you’d have enough information to evaluate capacity utilization, marginal costing, opportunity costing, and better valuation of real options. If every other facility is using the standard (somewhat arbitrary) cost accounting, you’d have great arbitrage potential for procedure selection in the hospital. You’d bill using the ‘normal and standard’ costs, but do only the cases where those ‘normal and standard’ overstate your actual costs.

Of course, capital utilization and marginal costing are facility dependent (sounds like constraint theory and throughput accounting, doesn’t it?) so that each hospital might prefer a different mix. Maybe there are a couple of savvy facilities out there now which don’t really want the confusing mess to be fixed—they’re taking advantage of the extra potential gains.

The ability to improve the processes from the data would be icing on the cake–leading to even better returns.

Anthony Wunsh • Thank you for the compliment Brian. I have given this a great deal of thought and work with a great many of facilites and physicians to change this culture from within.

Some food for thought, the status quo can not survive. We are costing ourselves out of existence.

And this is evident in the record number of hospitals that filed for bankruptcy protection or closed their doors in the last two years, the record number of docs retiring, selling or closing up shop as well.

And there is evidence that supports if you take the third party out of the equation, all participants realize financial benefits, patient and provider of care.

Thus why one in six practices is now a direct pay, concierge or hybrid model.

On the physician side at least, these model allow the facility to charge as much as 50% to 70% less for the procedure, visit and follow up as opposed to using the insurance pricing and actually make more money.

I am a big advocate that the transaction both financial and care delivery need to again be only between patient and care provider, I can substantiate that 40% of all cost of care is a direct result of the third party influence on how we get paid, what we charge, how much we are paid and the administrative burden these processes add to the actual cost of care.

And if you really want a little more detail on this here is a big picture review

450 bilion in patient balance went uncollected in 2011

300 billion in payer reimbursement went uncollected in 2011

It cost 385 billion to collect what we did a whopping 15% of all revenue just to get paid.

And if we were operating as a true business model, these numbers would not possibly be tolerated or even exist.

So give the industry back 1.1 trillion in either hard cost or lost revenue and what do you have, an industry that allows 40% of what they charge to be dicated by the third party influence.

Derrick Van Mell, MBA, MA • Boeing knows what a 747 costs to build down to a nickel–there’s no reason a hospital can’t have a comprehensive cost accounting system. Nor should it be satisfied with workarounds. Working the details is essential not only to control costs, but to improve quality: it’s an invaluable perspective into care delivery. 99% of what happens in a hospital every day is enormously routine. “It’s too hard” would not be accepted in any other industry. Healthcare should not try to invent it’s own way (and own terminology–again), but copy manufacturing’s proven, successful approach.

Robert Lewis CPA, MBA, FHFMA • All of you have great ideas and you are well positioned to advocate for them with your clients. I would be very interested in reading about your efforts and successes.

Colin Lay • I agree with Anthony, up to a point.

I don’t need a 3rd party payer to buy my car for me. I don’t have to buy a policy for that.

But I do buy insurance against the expenses due to accidents. I simply do not know what might happen or how bad it would be, if I had an accident. I expect that in some cases an insurer might refuse to pay for damage either to me or to someone else. There could conceivably be hundreds of thousands that might be assessed against me, if I happened to be at fault, and even if I were not at fault. How would I pay? That is why I buy liability coverage for about $2 million. I hope never to need it.

With medical care it is a different story. I might never be sick until the day I die, or I might get some disease that requires a long series of treatments with huge expenses.

For my transportation needs, if I can’t afford to buy and run a car, then I ride the bus or I stay at home, or I walk.

With cancer I either “buy” the treatment, or I wait in fear and trembling for something bad to happen. Can I say I can afford anything up to, say, $5,000, but beyond that I cannot go to hospital? Even at 50 to 70% off a procedure I might not be able to afford it. Many other people in my town might never have to face that decision, but what about me when I do? (In fact I did face that decision with Prostate Cancer. I chose a local surgeon rather than a Robotic Surgery hospital a few hundred miles away, 8 years ago. I could not afford the $70,000 self-pay price tag. I see my surgeon for another annual update in 10 days. I expect to be around for at least another 10 years, but then one never knows.)

How many real patients can afford to pay for their medical care all by themselves, with no insurance? A broken leg or arm, maybe. But how about a massive injury with broken leg, pelvis, ribs, internal injuries, and a hospital that says let me see your money first. Even Warren Buffet might be in trouble in an emergency, unless he has someone with him who has power of attorney to write the check.

I don’t think that living in the modern world without insurance is very pleasant. Not even with it, if there are massive deductibles, co-payments and coverage caps.

By the way, how much of those billions of dollars (450 + 300 = 750) consisted of inflated charges, which bore no relationship to the real cost of the provision of the services? What about the 30% of unwarranted services that don’t actually help the patients?

Brian Gregory, MD, MBA • To get back to the topic, “Why aren’t more hospitals adopting full-blown cost accounting systems?”…

Colin, you taught MHAs for (3?) decades. And you also developed and implemented a ‘full-blown cost accounting system’. Are you prohibited by NDAs from telling us how that went? Have any graphs? What did you do with it? Try anything we’ve suggested here? It’d be nice to hear from someone with the background and actual experience to tell us the good, the bad, and the ugly of the system.

Anthony Wunsh • Colin, rather than disagree with you I actually agree, insurance is a protection against against unforeseen catastrophic events that have the potential to financially ruin me.

However health insurance is far different than what it was and what it should be. It is maintenance insurance.

Imagine using your example of the automobile. Now assume you buy the car, but before hand the insurance company tells you what kind of car, where to buy it, how many dealers can sell it in your area, what price you must pay for it and where you can drive it and when.

And that is just the purchase of the car, now lets assume every time you need gas, the gas station attendant must first file a claim with the insurance company, then get paid some 45 days later if approved, and if your deductible is not met, then the gas station will bill you your balance.

Now imagine this gas station had to hire people to file these claims, use a special language to identify which gas you bought, how much and if the owner of the station really felt that you needed that gas.

Then imagine every time you needed an oil change, wipers changed, brakes and tires and any other service, this same process had to take place.

What do you think the cost of these goods and services would be inflated by.

And this is exactly what health care is in the US.

And to Brian’s point of getting back to the point, I believe this is the point, this is the only business that does not stop and look at the cost factors involved in the pricing and purchase of the goods sold.

And like it or not, health care providers are in business, are they not, the product they happen to sell is health care, but the same basic principals of business should be applied, if they were, the cost of care would be greatly reduced and from a moral perspective if cost is reduced access to care is increased, is it not.

If one would sit down and determine what it costs me to open a practice, dispense my product (care) and what makes sense for a price point and what can be eliminated, the third party costs are the major expense dwarfing all others and in fact all others combined in most cases.

And the lack of looking at our vertical through a business eye glass not only costs us far too much money to dispense care, but it also costs our customers (patients) far too much to purchase and receive care.

So a hypothetical to imagine, if the cost of care was reduced by 40%, would we pass this savings on to the patients, and if we did would the demand and need for insurance diminish?

Hospitals in particular, spend millions if not billions of dollars trying to reduce paper cost, or reduce procedure time, or reduce labor costs and facility costs and in most cases make little to no progress in the actual cost of operating the hospital, when the largest cost, the manner we get paid is left to other people to make these decisions.

And what are these decisions doing to hospitals and health care in general

Payer payments are continually being reduced, patient responsibility is continually increasing, mandates are placed upon the industry that increase cost yet do nothing to improve the delivery of care, yet increase the cost to the consumer and the cost to operate.

And the third party also allows the consumer, the patient to over consume and consume the most expensive care with no concern for cost.

It is a real challenge in the accounting and operational costs of care, that if looked at as stated above through the eyes of a business perspective is just plain dumb. Name one other industry that could or would allow this third party influence and survive.

Anthony Wunsh • Sorry group I just read again Colin’s response again and the last paragraph caught my attention.

“By the way, how much of those billions of dollars (450 + 300 = 750) consisted of inflated charges, which bore no relationship to the real cost of the provision of the services? What about the 30% of unwarranted services that don’t actually help the patients?”

I often marvel at how we so think we disagree on issues but in reality we agree, just how they are perceived or the causation is different.

To this question, in my opinion, it again is directly on point. Absorbing 1.1 trillion in losses or expenses, forces the industry to charge those who do pay, 1.1 trillion more. Again liken it to a retail store which adds the cost of shoplifting to all products sold which are actually paid for.

And this is exactly what managing cost versus price, or cost of goods sold, or cost to operate, or fixed costs versus variables, or managing time value of money, or all the other processes a business does by routine outside of health care would help to identify and resolve.

Again, can you name another business vertical that could survive this third party influence. It is just non existent.

So if the charges are inflated due to the cost of getting paid and other influences, then that 40% increase in charges is a result. And if that 40% increase in charges results in 49.3% of patient balances to go uncollected and 20% of payer balances to go uncollected, and adds 15% in administrative costs, it perpetuates adding the 40% inflated charges and the cycle never ends. I is just flat unsustainable.

Again there are highly intelligent folks contributing to this thread, and many reading but not contributing.

And the basic tenant is if we actually break down the cost versus charges, and look at hospital and health care in general from a purely financial aspect as a business, we could radically correct the cost factors, assuming of course we are willing and able to fight the special interests. But to stay the course. The topic is why aren’t more hospitals adopting full blown accounting systems to better manage revenue and expenses.

And the sad truth is most even with the information are either not reacting to it in a logical manner or powerless to make the changes necessary to enhance the outcome financially.

And the typical argument against this perspective, “health care is different” just does not hold up under scrutiny. It can and should be looked at from the financial aspect and the bottom line, so that the provider of care can then pass these changes on to the consumers (patients).

My mantra is we have a cost of care issue in the US, not a quality of care issue. And thus as costs increase, access to care decreases, regardless of what legislation is passed to stop it.

And as Brian aptly pointed out using tools to evaluate capacity utilization, marginal costing, opportunity costing, and better valuation of real options.

Add into this the cost of third party influence.

And I do want to state I have solutions, I am not just a bringer of bad news.

Simple things like making the patient responsible for claim filing and pre-cert, would make them more aware, would put immense pressure on the payer to deal with their own customer and would relieve some of the cost burden on the provider. Or perhaps having the payer pay 100% to the provider and then have them collect the deductible dollars and co-insurance back from their own customer, they have the only leverage to say if you don’t pay, we cancel your policy.

I don’t think the gravity of this cost factor is understood. Again 1.1 trillion dollars is lost to health care, put another way added to the cost of health care, as a result of the system in place.

What impact would not losing this, or not having to charge this have on the cost of operation and the cost of care? And this is the heart of the issue.

Alford Hardy • “The board report absorbed me totally into the moment. My mind flashed through scenarios and possible outcomes as I charted my way toward addressing the error. The report was off only by … well … tens of millions of dollars.” – Covering Your Assets by Exposing The Butt-Ugly Truth

The excerpt above leads to the question, How can you know what things cost when standard reporting has holes in it?

Derrick Van Mell nailed it. There is no reason we cannot know how much healthcare cost down to the individual patient. Also, notice that he said same approach, not transplanting systems.

The “too hard” seem to be a leadership decision to get it done and then a profession manager and the technical expertise to implement.

Enterprise solution for my area asset management,: Establishing data quality in everyday practices takes 6 months to a year – not hard. Costs and utilization of key assets and the impact on revenue, 2 to 3 months afterwards.

Brian Gregory, MD, MBA • I believe the current interest in TDABC is an attempt to address the greater influence that time has on typical costing in healthcare than in manufacturing. There’s a huge scheduling component that needs some concepts from systems engineering, plus a couple of finance concepts that need to be addressed. If you accept the fact that typical costing is a fiction, then simplify it to get useful comparative costs across processes, your results won’t be any more wrong in the absolute sense, but you’ll have a more valid relative ranking of cost and value.

Brian Gregory, MD, MBA • Think of it as an ‘opportunity’ costing system. It needs to suggest the reallocation of scarce resources…and even dumping ballast. Isn’t that the goal of an enterprise costing system?

Brian Gregory, MD, MBA • Combining Anna’s original question: “Why aren’t more hospitals adopting full-blown cost accounting systems?”

“As a CFO, I need information that is accurate enough to support management decisions, that allows me to drive prices off of costs, but I don’t want to build a cost accounting system that takes more time and effort to maintain than the value of the information I get out of it,” said Adams. “The answer for Holy Name Hospital, and for many other hospitals, is a hybrid: the RVU (relative value unit) costing methodology.”

And Robert’s statement: “specially using an 80/20 approach. But that is a different idea, I believe, than a full blown cost accounting system that will at some point reach diminishing returns for the effort.. It would quickly become a massive bureaucracy, if done in a “full blown” manner. Ad hoc cost analysis in support of focused process analysis, I believe, is move useful at this stage of available IT solutions and internal analytical capability.”

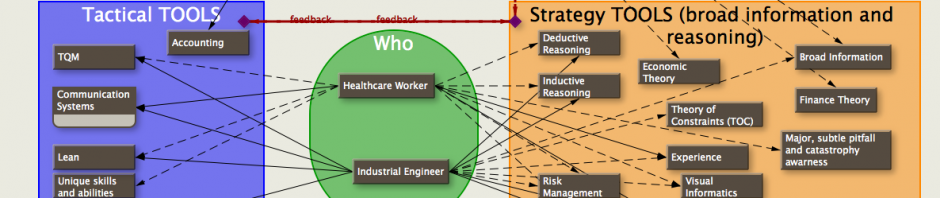

A simpler costing system that keeps track of marginal/consumable resources linked to the use of fixed assets and the times that each person is involved in a process and subprocess along with a database of similar and substitute processes would permit ranking of potential for Robert’s 80/20. Graphic visualization of the data along with input (and buy in) from clinicians would quickly focus on those changes that are possible and probable.

The decisions for capital purchases are based on forecasting and quickly become sunk costs. Once purchased, fixed assets should be used as strategically and tactically beneficial as possible (requires clinical knowledge to do that) and can’t be managed without consideration of scheduling and synergistic considerations on the micro level (can’t do that with accounting data). Analysis of the benefits of the original purchase (and possible future purchases) need to be the result of the benefits from that strategic and tactical use.

The brunt of the work of the CFO should be from that analysis…not from trying to figure out a better allocation of fixed costs and major process to every micro-process (better to assess the benefit of a global micro-process to major processes). The decision should be whether to dump a major process/strategy/asset because of its holistic effect. Systems/Industrial engineers and clinicians have the potential to change the net returns from implemented processes (as the example I gave from pediatric radiation). The crucial jobs of accountants is to recognize those holistic financial benefits. Get better engineers and savvy clinicians to improve the process; get a better CFO who can analyze and rank system financial results from the engineers and clinicians efforts.

An RFID (or equivalent) system like Alford’s makes it possible to quickly linked fixed and consumable/marginal expenses to time (TDABC). Colin’s accounting system cross-references/slices/dices and that data to give those rankings and substitue processes that I referred to. The capability is already there.

IMHO…the reason that more facilities aren’t using full-blown cost accounting systems (engineering) is due to outdated, time intensive cost accounting methods that don’t give useful managerial data, and hence the benefits don’t materialize. Industrial/systems engineering has made incredible progress (with the help of Deming, Goldratt, and others). Where’s the equivalent push of lean, six-sigma, kanban, and throughput in the healthcare accounting field? Better accounting methods have been used in academia and other industries for years. The focus on cost plus billing has killed healthcare accounting innovation.

Brian Gregory, MD, MBA • …and in the process harmed healthcare systems engineering and clinical innovation. Isn’t that why there’ve been changes in reimbursement schemes?

Brian Gregory, MD, MBA • As examples:

Accounting can be used to assess the total result of each the following scheduling techniques, but would miss the benefits if used solely for the individual OR cases:

===

https://ortimes.org/wp-content/uploads/2013/03/shs2013-clarifying-or-turnover-time-concept-graph.pdf

===

neither could accounting for individual cases see these technique benefits:

===

https://ortimes.org/wp-content/uploads/2013/03/shs2013-clarifying-or-on-time-starts.pdf

Alford Hardy • @ Dr. Gregory

I saw the publication on your profile and downloaded it earlier this morning. As an asset manager, my concerns center around whether the equipment and applications in the OR actually have value to the physicians, nurses, technicians, and staff using them. If the assets have value, how are they best managed from a life cycle standpoint (acquisition, utilization, maintenance, disposition). Capturing and analyzing the appropriate data is part of that life-cycle.

If you send me a linkedin email with your regular email address, I can send you one slide that, I think, reinforces your points about cost accounting in a novel way and points to a solution as well.

Brian Gregory, MD, MBA • Al,

The right/wrong and working/not working equipment has a huge time effect with repercussions throughout the rest of the OR, preop, postop, and other areas. The cost in risk and personnel time can be significant.

—

brian@ortimes.org

Brian Gregory, MD, MBA • The point is that the design of any full-blown cost accounting system should include the ability to create positive feedback loops with engineering and clinicians.

This assumes that there is not an adversarial relationship among the different groups…which could be exacerbated by insurance, independent financial concerns,etc. Taken a step further, this adversarial relationship helps explain the high cost of healthcare in the US compared to some other countries.

Alford Hardy • “Feedback loops…” Absolutely!

http://www.amazon.com/Covering-Assets-Exposing-Butt-Ugly-ebook/dp/B007OM83GU

The problems listed in this thread is captured in the Chapter 1 title, Naughty Piece of Paper.

Brian Gregory, MD, MBA • Ha! I just remembered a discussion on LinkedIn from a year ago dealing with accounting techniques for hospitals. I copied it to my weblog:

https://ortimes.org/2012/04/05/throughput-accounting-a-natural-for-hospitals-linkedin-thread/

Todd Kemp • Dear All I am a bit late to this conversation

I agree that we cannot continue on these minimalistic averaging costing methods. The amount of waste in healthcare is huge.

This does mean change and Change is the only word really stopping this happening. If clinicians do not want it, ”It will fail”. This will get worse as staff continue to fight fires rather than implementing a longer term view of a planned managed solution. Many systems are implemented by using current employed staff without adding or backfilling their FTE causing good people to become stressed and both the future and current processes get neglected. PLEASE give internal resources the funds to really make a difference under new project initiatives.

So back to the point ………………..

The ability to provide ABC within a healthcare environment is made difficult due to the many business modules, departments, layers and disparate systems utilized. By providing a web based layered interoperable technology between / across these systems (Financial, Clinical and Materials) allowing transactional data to the decision maker at the point of use is the key to both data capture, production management and resource/asset enhanced utilization across the healthcare continuum.

NXTLean™ is defined as a “method” of optimising all resources as a service based upon integrated communication between disparate systems and providing accurate transactional data to the point of use, for real time decision making capability.

This type of solution provides the tool set that can be leveraged by LEAN initiatives to provide sustainable production, quality outcomes and improvements. Without this most Lean initiatives will not be sustainable over time.

The outcome of a web based, layered interoperable system that implments the NXTLean method is the ability to get your hands on real time transactional data. This data set will allow all the ABC across the system not only for say perioperative services but the complete communication and systems architecture of the facilities multi-level and disparate systems.

Next time you hear a CIO or CFO say I would love to have or know – then Think NXTLean as the method of providing cross boundary access to information at the point of use that will allow global reporting against.

Many thanks

Todd Kemp SurgiDat.com

Brian Gregory, MD, MBA • Define ‘full-blown cost accounting system’.

Is a system that ignores important information related to costs that would significantly alter the processes of the company a ‘full-blown cost accounting system’? Or is it better called an ‘enterprise bookkeeping system’?

Here’s another blog from over a year ago detailing a common serious mistake that would be overlooked by an enterprise costing system if it did not take into consideration time and scheduling. TDABC(at least) should be used. Hiring, firing, and misallocation of personnel would be involved. Risk would be involved.

===

https://ortimes.org/2011/09/08/fte-vs-cost-accounting/

Jim Smith • Today’s challenge, dare I jump in where I probably have absolutely no business being.

Sorry to do this, but I’ve read the entire thread and I’ve been wondering for years where to get the answer for the following. For nearly 20 years I have been offering Fortune 500 CEO’s a unique expense reduction process that is based entirely on anonymous employee suggestions that are processed through a CEO sponsored system that creates a barrier to political or cultural interference. The process takes only ten weeks and actually improves morale. We’ve performed it for utilities, insurance, manufacturing, banking, even a internet company. For one utility who after a year long project accomplished only a $25 million reduction, our ten week CEO sponsored process generated a sustainable $300 million SG&A reduction, a $200 million reduction in already approved capital and $45 million one-time inventory reduction. All this in a heavily unionized company and all through employee suggestions shielded from politics and culture. Similar results were accomplished for every single client, albeit small numbers.

This process is highly structured, there are rules for officers and rules for employees and once it gets started and management actually takes action, it’s hard to stop the input. It is 100% based on human nature.

Why would this approach not work in hospitals, which probably have more intelligent employees than most businesses?

To give you an idea of our faith in the process, there are no invoices for labor or expenses during the 10 weeks and our ultimate fee is customer chosen. Having said that, our margins are off any reasonable scale because of the results, which have always exceeded 10% of operating expenses.

Is it a complete waste of time marketing to hospitals? Why? Is there something so unique about hospitals that human nature would not act?

Brian, what do you think?

Stuart Singer • Jim,

I don’t mean you any disrespect but your approach is a scaled down version of Lean which several hospitals have used very successfully to improve quality and efficiency and reduce costs.

The difference in the two approaches appears to be that Lean is staff level driven, with support from Lean experts, while your approach suggests that problem solving and innovation originate from the C-Suite. I’m not suggesting that lower level staff are not included in your approach but, since you didn’t mention staff participation, it appears that their contribution ends with the submission of ideas and does not include driving and contributing to development and implementation of solutions.

Brian Gregory, MD, MBA • Jim,

There are quite a few people reading these comments who transferred into healthcare from elsewhere. They’d have some insightful answers to your question.

Brian Gregory, MD, MBA • “Eventually, medical tourism (system competition) will resolve this as long as there are barriers to that competition. Hopefully, I’ll live long enough to see it.”

correction:

‘Eventually, medical tourism (system competition) will resolve this as long as there are

NOT barriers to that competition. Hopefully, I’ll live long enough to see it.’

Brian Gregory, MD, MBA • Hi Alford,

Just finished reading your book. Can’t say much about the title, and the beginning was a little slow, but the last half was quite informative. Reading between the lines was also fun. Wish I could have seen your presentation at HIMSS11.

I see why you’re interested in this conversation thread, and I can see some further modifications and uses of RTLS that jive quite well with my scheduling work. Lots more potential. Seems naturally a part of any enterprise costing system.

Brian Gregory, MD, MBA • ” “The answer for Holy Name Hospital, and for many other hospitals, is a hybrid: the RVU (relative value unit) costing methodology.”

Can anyone tell me how RVU could work? I see too many reasons that it wouldn’t. Maybe I’m missing a particular, unique value that it might have.

Paul A. Markham, MBA, Ph.D. • Why aren’t they is a good question. I think all that needs to be added is …yet! There is no doubt fiscal super efficiency is required as cost heavy chronic diseases enter the healthcare environment in ever greater baby boomer numbers. Great topic.

Brian Gregory, MD, MBA • Let’s see…

Alford’s RTLS saves significant costs by utilizing existing assets more efficiently. (frees up cash flow; does not judge the ‘goodness’ of treatment; could be used to correlate time with use, and evaluate utilization with procedures)

Todd’s system collects data linking processes and materials. (can be used to decrease the use of scarce assets that Alford’s RTLS helps locate, thus further freeing up cash flow; can be analyzed for best process implementation for a particular DRG). Can collect and forward time and use data to to help judge relevance and goodness of various process techniques.

Colin’s system integrates all that data, exposes unnecessary procedures for a DRG (diagnosis and treatment), correlates it with other information to see the ramifications throughout the system of any choices made for materials (feedback to Alford) and processes (feedback to Todd). Judges everything. Would be good for fixed payment per person or DRG. Frees up cash flow to hospital and society at large.

Nice feedback potential…would get better with age.

Or, you could use some standard, non-process and event specific method of grossly allocating the cost of fixed assets and personnel to everything within a silo which gives you….hmmm, give me a moment, I’m thinking……

GIGO. Maybe that’s why many hospital don’t see the value of a full blown hospital accounting system.

Brian Gregory, MD, MBA • One last link to an OR scheduling example to show that you really do need to talk to clinicians when evaluating cost and revenue:

—

https://ortimes.org/2010/01/21/graph-of-crna-usage-for-optimized-surgeon-schedule/

Brian Gregory, MD, MBA • The warp and woof of healthcare accounting?

Throughput accounting(TA) and Time driven activity based costing (TDABC)

TDABC is extremely useful for enterprises –comparing [benchmarking] information for similar processes (subprocesses) across silos with the added perk (since it’s all in-house) of being able to compare the minutiae of the differences.

TA (throughput accounting) is useful within a clinical process (silo) made of multiple subprocesses. Each higher process level (hierarchical and based on contraints) is led by global strategies/goals (from top to bottom) and demands clinical and systems engineering inputs and design. Continuous reassessment as strategies change keeps the information flowing up and down the hierarchical chain.

TDABC — CFO gets leads for possible subprocess improvements for engineers and clinicians.

—

Throughput Accounting — Silos (clinicians and engineers) get strategies/goals from CEO & CFO and find best way to put subprocesses together to implement their part. Hierarchical with feedback up and down the line.

Feedback?

Pingback: throughput accounting…a natural for hospitals? Linkedin thread. | ORTimes

Pingback: throughput accounting (TA) vs activity based costing (abc)… | ORTimes

Pingback: FTE vs cost accounting … when PUNs equal CUEs | ORTimes

Pingback: Synergy of TDABC and Throughput Accounting… | ORTimes